What Is a Tax Write-Off and How Do They Work?

Another factor that creates confusion is that businesses are allowed to deduct a wider range of expenses from their profits. When it comes to the question of “how do tax write-offs work,” there’s a common misconception that a tax write-off means an expense doesn’t really matter; that the IRS is picking up the bill. A payroll software or service can help you save time, reduce errors, boost security and stay compliant. Insurance can typically be deducted if it’s an ordinary and necessary expense for your business. Please consult your CPA or tax professional, or review IRS instructions, to understand your specific situation.

Also, it’s possible that an expense can be legitimate but excluded from being deductible on your taxes. If you are self-employed you may not know all of the different business deductions you are eligible for, but TurboTax Self-Employed will search tax deductions specific to your industry. People dread running afoul of the IRS so much that when Congress passed Biden’s infrastructure spending package, crypto prices fell across the board.

How Do You Apply a Write-Off

Once you have confirmed which types of expenses you can deduct it is important to keep a record of qualifying expenses. Working with an adviser may come with potential downsides such as payment of fees (which will reduce returns). There are no guarantees that working with an adviser will yield positive returns. The existence of a fiduciary duty does not prevent the rise of potential conflicts of interest.

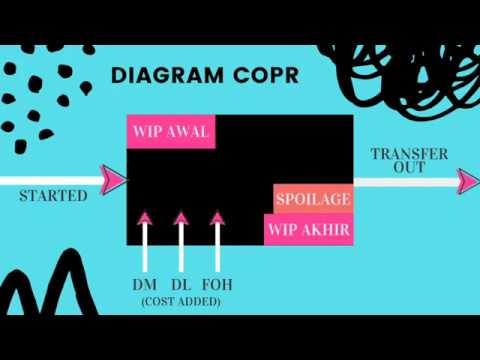

If they refuse to pay, you may eventually give up on collecting the debt. In that case you would report the $10,000 on your taxes as a loss. When a business reports its income, losses and total profits, it does so through the system of revenue and write-offs. Revenue is the amount of money that a business makes from all sources over the course of the year. Losses refer to the money that business spends on all qualified expenses in that same time period. In business accounting, the term ‘write-off’ is used to refer to an investment (such as a purchase of sellable goods) for which a return on the investment is now impossible or unlikely.

Those servicing a mortgage can also deduct interests on up to $750,000 of the debt. If you’re saving for retirement, a traditional IRA allows you to make a tax-free contribution, but you’ll need to pay taxes when you start taking withdrawals. People running a home office can also deduct certain business expenses.

Expert does your taxes

Hopefully, it will help answer any questions you may have about what a write off is and how they work. Businesses are only allowed to deduct legitimate business expenses. They can deduct a portion of the cost of a restaurant meal if they are eating with a client or potential client, but they cannot deduct personal expenses. Likewise, travel expenses are only deductible if the travel was required for business operations.

It’s also absolutely critical to keep the documentation for all write-offs that you intend to claim. If you make a mistake, receipts can be the difference between a quick check-in from the IRS and a full-blown audit. One way the federal government helps taxpayers deal with expenses is by allowing you to reduce the amount of income you pay tax on. This happens by deducting certain expenses when you’re ready to file your federal income tax return.

deduction

When compiling year-end tax reports, it may help to devise a system that groups expenses into categories that match the IRS forms. If you use tax software, you may be prompted to enter common expenses that qualify as a tax write-off. To fill out a Schedule C, you need a copy of your business’ profit and loss statement (aka income statement) and balance sheet. If you sell inventory, you need information on your cost of goods sold.

Did you know you can simultaneously do good and get a tax write-off? While charitable donations are a common tax write-off, they are still overlooked because many people don’t think they donate enough per year to qualify. Contributions to HSAs are tax-deductible, and the withdrawals are tax-free, too, as long as you use them for qualified medical expenses. Gambling losses and expenses are deductible only to the extent of gambling winnings. So, spending $100 on lottery tickets isn’t deductible — unless you win, and report, at least $100, too. The credit is worth 100% of the first $2,000 of qualified education expenses paid for each eligible student and 25% of the next $2,000 of qualified education expenses.

Legal and professional fees

But how do you know what kinds of things qualify as tax write-offs? Here’s an overview of how tax write-offs work and what kinds of write-offs taxpayers should know about. This practice is known as “writing off a loss.” It applies to when you have assets destroyed or give up on collecting money someone owes you. For example, if your business owns a car worth $10,000 and it gets destroyed, you might write that vehicle off on your taxes. The same is true if someone owes your business $10,000 in payments.

Generally 50% of the cost of business meals costs (including any tip) are deductible. During the pandemic (2021 and 2022 tax years) this amount rose to 100% for restaurant meals, but it’s back down to 50% starting January 1, 2023. You can’t deduct capital expenses but you may be able to recover the amount you spend through depreciation, amortization, or depletion. In other words you can get a tax benefit over time, rather than immediately. It might be a good idea to consult with a qualified tax professional to help you figure it all out.

The IRS determines what expenses can be considered legitimate write-offs. Don’t worry about knowing which tax deductions and credits are deductible. TurboTax will ask you simple questions about you and give you the tax deductions and credits you’re eligible for based on your answers. You can only deduct expenses that the IRS allows to reduce your taxable income. Claiming tax deductions available to you is perfectly fine and you can be confident that you aren’t breaking IRS rules. Still, it’s important to know your limits when seeking tax write-offs.

Gov. Justice signs bill to resolve vehicle property tax credit confusion – Governor Jim Justice

Gov. Justice signs bill to resolve vehicle property tax credit confusion.

Posted: Wed, 16 Aug 2023 17:21:22 GMT [source]

Businesses can be classified as small businesses based on revenue, sales, assets, or annual gross or net profits, but the number of employees is a common measurement used to classify small businesses. Still, business owners often find they can take advantage of a variety of tax deductions to reduce the amount owed. There are a few common personal tax write-offs it might help to know about. So before you file your taxes, make sure to do your research and know what deductions apply to you. So if your tax bill is $3,000, but you have $1,000 in tax credits, you might only have to pay $2,000 in taxes, for example.

A simple way to reduce your possible income tax bill is to make sure you are claiming all the tax deductions available for your small business. As a small business owner it will be essential to keep good books and records of your business income and expenses to make sure not to miss out on any tax-write offs and cost you more money. Quickbooks can help you manage Tax write off your business finances in one place to make sure you are prepared come tax time. Some common tax write-offs for small businesses include rent expenses, telephone and internet expenses, bank fees, and contract labor to name a few. Each business will have some expenses that are specific to their business or industry that can possibly be a tax write-off.

The maximum contribution for 2022 in a traditional or Roth IRA is $6,000, plus another $1,000 for people who are 50 years old or more. You can deduct mortgage insurance premiums, mortgage interest and real estate taxes that you pay during the year for your home. The program could cut monthly payments in half or even to $0 for borrowers. Many will save up to $1,000 a year on repayments, according to the Biden administration. In addition, the department’s review of Federal Student Aid suggested that struggling borrowers were placed into forbearance by loan servicers, in violation of DOE rules. Look for an email from your loan servicing company, which began alerting people about the debt forgiveness on Monday, according to ABC News.

Luckily, there are some relatively easy tax deductions that small business owners may be able to take advantage of in 2023. Business owners may be able to write off certain business-related expenses. Keep in mind that owning your own business is different from being self-employed. And it’s important to know which category you fall under, so you can file your taxes and calculate your deductions correctly. A business can claim write-offs for all legitimate, qualifying business expenses as defined by the IRS. Generally this includes all spending that is both necessary and relevant to running your specific business.

- You may be able to write off some or all of your startup business expenses but you’ll need to follow IRS rules and limitations, which are spelled out in IRS Publication 535, Business Expenses.

- Business deductions refer to qualified expenses that reduce a business’ total taxable income and therefore reduce business taxes.

- Note that if you get insurance to secure a small business loan, you can’t deduct the premium.

- Generally Accepted Accounting Principles (GAAP) detail the accounting entries required for a write-off.

- Another factor that creates confusion is that businesses are allowed to deduct a wider range of expenses from their profits.

A tax deduction, also commonly called a “tax write-off,” provides a smaller benefit by allowing you to deduct a certain amount from your taxable income. Another consideration with tax deductions is that they won’t do you much good unless you itemize your deductions, which only makes sense for people with a considerable amount of deductible expenses. Standard deductions apply to personal tax returns, not businesses. But again, even though small business owners may file small business tax returns, business income and expenses often flow through to the business owner’s personal return. These deductions are subtracted from your gross income to determine your adjusted gross income, or AGI. If you qualify, you can take them regardless of whether you itemize or take the standard deduction.